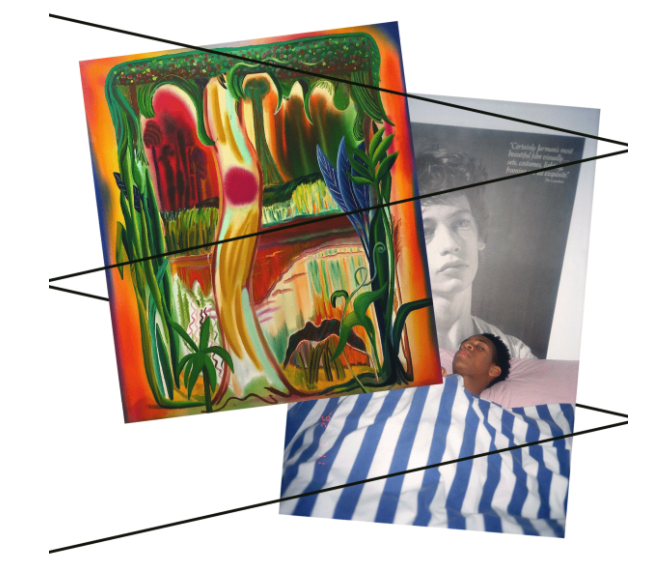

Occupy Museums, Installation Overview

Mar 17, 2017

0:00

Occupy Museums, Installation Overview

0:00

Arthur Polendo: The installation you are now looking at represents a community of artists who are in debt. The members of our group are also part of this community. We developed a visual language that is intended to help us see art differently and for you, the viewer, to see yourself and your life in this work. We invite you to participate in building out our conceptual map of the relationship between debt and art in America.

Looking to the right, you will notice the Large Projection that displays the work of all of the artists who have joined Debtfair. So far there are over 500 individuals, plus a few collectives, and this number will grow during the exhibition and beyond. If you are an artist and wish to join the network, your work will be displayed here as well. Each image shows a single artwork by an artist and its title along with a short narrative about their economic reality. Under the large projection there are 3 monitors, one of which is wheelchair accessible. Here, you can interact with the project by creating a profile in the Debtfair.org system and browsing through more artist profiles.

Looking to the left, you will see a large wall, 30 feet in length, stretching floor to ceiling. The top text on the wall is a quotation by Larry Fink, the CEO of Blackrock, the world’s largest asset management corporation, also known as the world’s largest shadow bank. Blackrock is the single largest financial institution in the world, with shares in roughly 40% of all publicly traded companies in the U.S., the largest single shareholder in one out of every five U.S. corporations, including all major banks, and one of the largest shareholders in companies around the world.

With around $5 trillion in assets under management and around $15 trillion in assets under advisement, BlackRock is a global economic force roughly equal to entire U.S. economy. In addition, BlackRock is largely unregulated and is incredibly powerful; it is understandable why Donald Trump would want Fink on his Economic Advisory team. Here, we have made visible the two degrees of separation between individual artists and this formidable company which profits from their debt.

Farther down on the left side, there is a key to the large diagrammatic lines that stretch all the way across the wall. These jagged, hard-edged, yet colorful lines reference actual stock market graphs tracking debt profits and art market activity. Look to the key for specific relationships on how the graph lines function. You can think of these as two of the fault lines causing the earthquakes and general instability and precarity that artists and most Americans face as the elite financial sphere grows in influence.